Originally Published: March 2025 | Last Updated: August 2025

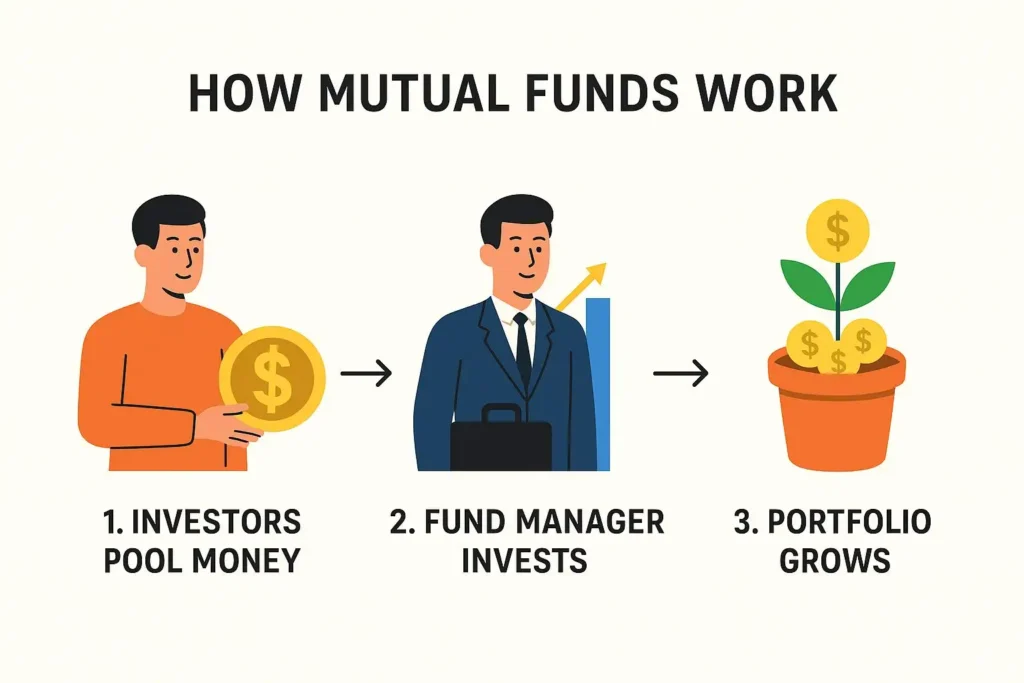

Imagine planting a tiny seed and watching it slowly sprout into a flourishing plant. That’s the power of mutual funds investment: pooling your small contributions with others so your collective money can grow in a professionally-managed portfolio.

Think of it like a group of friends each chipping in to buy a giant cake – everyone gets a slice proportional to what they paid. Mutual funds work the same way: you and thousands of other investors pool money to buy a diversified mix of stocks, bonds, or other assets, managed by experts. Over time, as those investments generate dividends or rise in value, each investor’s slice of the “cake” grows.

This guide will demystify mutual funds through clear analogies and step-by-step tips. We will cover how mutual funds work, the main types of funds, step-by-step “how to invest in mutual funds” advice for each & every country and individual, also bust common mutual fund myths. By the end, you will feel empowered to plant your own seeds of wealth and watch them grow.

What Is a Mutual Fund? (Think of It Like Teamwork)

A mutual fund is essentially a team effort in investing. Instead of putting all your money into a single stock or bond, a mutual fund lets many people pool their cash together. This joint pool is used to buy a diversified “basket” of investments – from company stocks to government bonds. You can think of each share of the mutual fund as owning a proportional slice of this basket. As the fund’s assets grow (through stock price gains or interest payments), the value of your share grows too.

In practical terms, when you invest in a mutual fund, you buy its shares at a price called the Net Asset Value (NAV), which reflects the current value of the fund’s holdings. The U.S. SEC explains that “each mutual fund share represents an investor’s proportionate ownership of the mutual fund’s portfolio and the income the portfolio generates”. If the portfolio does well, the NAV goes up; if it dips, the NAV goes down. You can redeem (sell) your shares back to the fund on any business day at the then-current NAV.

Story for you: Imagine 100 friends each put $10 into a pot to buy several company stocks. A fund manager (the captain) uses that $1,000 to purchase a mix of securities. One year later, some of those stocks went up and paid dividends, and the pot is worth $1,200. Now each friend’s share is worth $12 instead of $10. Similarly, mutual funds pool money to access big opportunities (even ones that might be too expensive for one person alone) and share profits with investors.

Types of Mutual Funds: Equity, Debt & Hybrid

Mutual funds come in a few major categories, each with a different goal and risk level:

• Equity (Stock) Funds: These invest primarily in company stocks. They aim for capital growth by riding the stock market. Equity funds can range from conservative (like large blue-chip companies) to aggressive (small, fast-growing companies). Historically, equity funds carry higher risk but also higher potential returns. Example: A U.S. large-cap equity fund that holds S&P 500 companies.

• Debt (Bond) Funds: These invest in bonds and other fixed-income securities. They seek steady income (from bond interest payments) and tend to be less volatile than stocks. Bond funds might invest in government bonds, municipal bonds, or corporate bonds. The goal is to preserve capital and earn income. Because bonds typically have lower returns than stocks, debt funds usually have lower risk (though not no risk).

• Hybrid (Balanced) Funds: These funds mix stocks and bonds in one portfolio. The idea is to balance growth and stability. A hybrid fund might invest 60% in stocks and 40% in bonds, for example. This blend helps smooth out ups and downs: stock gains can boost returns, while bond income provides a cushion. Hybrid funds are often favored by those seeking moderate growth with moderate risk.

(Note: There are also specialty funds like money market funds (super-safe cash equivalents) and target-date funds (that automatically shift mix over time). But for beginners, focusing on equity, debt, and hybrid covers most needs.)

When choosing a fund, consider the fund’s objective and risk level. For instance, if you want more stability, you might lean toward debt funds or conservative hybrid funds. If you aim for long-term growth and can handle volatility, equity funds might suit you. Tip: Look for funds with low fees and solid track records. Often, many sources list index funds or no-load funds from Vanguard, Fidelity, or T. Rowe Price as the “best mutual funds for beginners,” since they offer broad diversification and low costs.

How Mutual Funds Work

Let’s walk through how a mutual fund works in a relatable way. Suppose Maria decides to invest $500 in a growth-oriented mutual fund that mainly holds tech stocks. On day one, the fund’s NAV is $50 per share, so Maria buys 10 shares. Over the next year, the tech stocks in the fund do well: one company pays dividends, another goes public at a higher price. As a result, the fund’s NAV increases to $55. Maria’s 10 shares are now worth $550. If Maria sells (redeems) her shares, she would get $550 back (minus any small fees). Essentially, her money has “grown” thanks to the pooled investments.

Conversely, if the market had a downturn, the NAV could fall. For example, if a key stock price drops, the NAV might go down to $45. Maria’s 10 shares would then be worth $450 — meaning a temporary paper loss. This illustrates that mutual fund returns float with market performance. Importantly, mutual funds are not insured by the FDIC or any government body – you share in the fund’s gains and losses.

Another everyday analogy: Think of a mutual fund as a shared pizza order. If you and 9 friends each pay $20, you get a large pizza with many toppings (stocks, bonds, etc). When the pizza (fund) is delicious (stocks do well), everyone enjoys a tasty slice (financial gain). If some slices are smaller (a bad stock), it affects everyone’s share. But because the pizza had many toppings, one bad bite won’t spoil the whole meal (diversification). And you didn’t have to buy a pizza oven to enjoy it – likewise, you do not need to be a finance expert to benefit from a mutual fund.

Step-by-Step: How to Invest in Mutual Funds

Investing in mutual funds follows similar steps worldwide, but each country has its own popular platforms and rules. Below is a general how to invest in mutual funds roadmap for major regions:

1. Set Your Goals and Budget: Define what you are saving for (retirement, a house, education) and your time horizon. Decide how much you can invest monthly or as a lump sum.

2. Assess Risk Tolerance: Are you comfortable with market swings or do you prefer stability? This will guide your fund choice (equity vs. bond vs. balanced).

3. Choose the Right Account and Platform: You need an investment account (in your name) with a financial institution. This could be a brokerage account or a retirement account (like an IRA in the U.S. or a pension/ISA in the UK). Choose a reputable, regulated platform in your country (examples below). Ensure they offer mutual funds and check fees.

4. Select the Mutual Funds: Research funds that match your goals and risk. Look at expense ratios, past performance, and fund management style. For beginners, consider broad-based funds (index or target-date funds are often cited as best mutual funds for beginners because of their simplicity and diversification).

5. Invest and Monitor: Open the account, deposit money, and place an order to buy fund shares. Many platforms let you set up automatic investments (SIP/DCA). Review your investment periodically to see if it’s on track.

Below are region-specific tips:

• United States: You can invest through major brokerages or directly with fund companies. Top U.S. platforms include Fidelity, Vanguard, Charles Schwab, and so on. Many no-commission accounts let you buy their funds fee-free. For example, Vanguard won’t charge you a commission when you buy a Vanguard fund through Vanguard’s site. Start by opening a brokerage or IRA account with one of these firms. Verify it’s registered with the SEC and covered by SIPC for protection. Then choose funds (U.S. investors often use funds within tax-advantaged 401(k)s or IRAs) and buy.

• United Kingdom: UK investors use online platforms often called “wealth managers” or brokers. Popular ones are Hargreaves Lansdown, AJ Bell Youinvest, and others. First, open an account (or a Stocks & Shares ISA/SIPP for tax benefits). Make sure the platform is regulated by the UK’s Financial Conduct Authority (FCA). After funding the account, search for mutual funds (often called “unit trusts” or “OEICs” in the UK). Pick funds by name or sector. For example, a global equity fund or a UK government bond fund. Enter the amount to invest and place the trade. The steps are: 1) sign up at a regulated platform, 2) search/browse funds, 3) deposit GBP, 4) buy your chosen fund(s).

• Canada: Canadians invest via banks, brokerages, or fund companies. Common platforms include big banks (RBC Direct Investing, TD Direct Investing), discount brokers (Questrade, Wealthsimple Trade), and robo-advisors. You’ll often use registered accounts like an RRSP or TFSA to get tax advantages. For instance, TD explains that “profits earned from mutual funds held within registered accounts like a RRSP… won’t be taxed until you withdraw them”, and income in a TFSA is tax-free. Steps: open an account (e.g. TFSA) with your chosen provider, fund it (CAD), then buy mutual fund units. Similar to other regions, you can invest via lump sum or an automated plan. Use resources like Morningstar Canada to compare funds, and remember: 64% of Canadians already invest this way, so you’re in good company.

• Philippines: In the Philippines, mutual funds are regulated by the local SEC. Start by choosing a licensed mutual fund provider or bank-based distributor (names like ATRAM, Sun Life, BPI Funds). Complete their KYC paperwork and open an account. You typically need as little as ₱5,000 to start. After funding your account, select a fund (e.g. an equity fund or balanced fund). You can usually do this through the fund house’s office or online portal. Keep in mind that mutual funds (not covered by PDIC insurance) allow you to redeem shares at any time for the NAV. The procedure is: research a reputable fund manager (regulated under RA 2629), open an account with them, deposit pesos, and instruct them which fund to buy. Monitor your NAV monthly via statements or their website.

Key Tip: Regardless of country, always verify the platform is legitimate (e.g. SEC-regulated in the US/PH, FCA in UK, CSA in Canada) and understand any fees involved. Large, well-known platforms often offer a wide range of funds (including many best mutual funds for beginners on their lists) with easy online dashboards.

Common Mutual Fund Myths Debunked

Even smart people sometimes hold incorrect beliefs about mutual funds. Let’s set the record straight on a few mutual fund myths debunked:

🤯 Myth: Mutual funds are only for the rich. Reality: Not at all! Many funds have very low minimums. In fact, investors in India can start with just ₹100, and in the Philippines with ₱5,000. In the U.S. and Europe, some funds let you invest even $50–$100 to get started. Platforms often allow small, regular contributions (Systematic Investment Plans). You don’t need a fortune – you just need to start. Even experts point out that mutual funds are accessible to everyday investors.

🤯 Myth: All mutual funds are super high-risk. Reality: Funds come in risk varieties. Yes, equity funds can swing in value, but there are many low-risk options like bond funds or money-market funds. As HDFC points out, while some schemes are riskier, “many low-risk options” exist. A government bond fund or a conservative balanced fund can be quite steady. Choose based on your risk comfort: you can find funds ranging from very safe to very aggressive.

🤯 Myth: Mutual funds guarantee huge returns. Reality: No investment is guaranteed. Mutual funds can gain or lose money depending on markets. They help spread risk, but if markets fall, your investment value falls too. A prudent approach: focus on reasonable long-term growth rather than “big wins.”

🤯 Myth: You have to be a stock-picking expert to invest in funds. Reality: Exactly the opposite! Mutual funds solve that problem by hiring professional managers. HDFC notes beginners benefit because funds are “managed by professionals,” making them suitable even if you’re not a finance guru. You just choose the type of fund; the experts do the research and trading.

🤯 Myth: All mutual funds have hefty hidden fees. Reality: Fees vary widely. While some funds charge loads or high expense ratios, many charge very little. Look for no-load and index funds. In fact, guides for beginners recommend companies like Vanguard, Fidelity, and T. Rowe Price, which offer low-cost, no-load funds. Even online brokers often provide commission-free fund trades. Always check the expense ratio (annual fee) and any upfront/sales fees before investing.

🤯 Myth: I should buy funds that had the highest past performance. Reality: Past performance is not a reliable predictor. A fund might have done well last year due to luck or hot sectors. Look instead at fund quality: consistent strategy, low costs, and professional management. Read reviews or use tools on sites like FINRA’s Fund Analyzer (US) or Morningstar.

By busting these myths, you can approach mutual funds with clear eyes. Remember: mutual funds investment is about consistent, patient growth, not quick riches. Diversification and professional management give you an edge, but nothing is risk-free.

Quick Self-Assessment Questions

Before you jump in, ask yourself a few questions to sharpen your strategy:

• What are my financial goals and timeline? Are you saving for retirement decades away, or a down payment in 5 years? Your timeframe will affect whether you choose aggressive (equity) or conservative funds.

• How much risk can I handle? On a scale of 1 (very low) to 10 (very high), rate your comfort with market ups and downs. Funds come in different risk levels, so knowing this helps you pick equity vs. balanced vs. bond funds.

• What can I invest regularly? Even small amounts add up. If you can set aside $50–$100 per month, which fund could grow most effectively with that contribution? (Many platforms let you set automatic monthly buys.)

• Which mutual fund myth did I believe before? For instance, were you worried mutual funds require lots of money or expertise? Check the facts above – you might be closer to qualifying to invest than you thought.

• Have I checked the fund’s fees and regulation? Ensure any fund/company you consider is regulated (by SEC, FCA, etc.) and compare expense ratios. Lower fees often mean more of the return stays in your pocket.

Reflecting on these makes investing less daunting. When you are ready, start small and build confidence as you go.

Summary: Empower Your Wealth-Growth Journey

Mutual funds can be a smart, accessible way to grow your wealth over time. By pooling your savings with many others, you gain instant diversification and professional management – important tools for building a secure financial future.

Whether you’re in the US, India, UK, Canada, the Philippines or any country the core steps are the same: clarify your goals, pick a safe platform, and choose the right mix of funds. Along the way, remember that mutual funds investment is about steady progress. These funds earn returns through dividends, interest, and rising asset values. Over the long term, compounding these returns can significantly boost your wealth. (Indeed, experts say quality mutual funds “possibly have the capability to generate significant returns” for long-term investors.)

You have now seen that common fears – like needing to be rich or an expert – are myths. Even beginners can start with small amounts and learn as they go. By staying informed and disciplined, you harness the same financial tools used by many seasoned investors.

Now it’s your turn. Start planting your investment seeds today with confidence. Stay curious, ask questions, and feel proud as you watch your portfolio grow.

Call to Action: Did this guide help demystify mutual funds for you? Share your thoughts or questions in the comments below. Subscribe to TheFitFinance for more investing tips. Your path to smart wealth growth is just beginning – let’s walk it together!

Want to grow your fund faster > Read Article > Double Your Savings in Just One Year: Proven Strategies for Rapid Financial Growth